This early direct deposit feature is easy to activate. With Chime, direct deposits arrive up to 2 days early^ (as soon as your employer deposits it), ensuring you have all the funds you need to pay your bills on time and keep financial stress to a minimum. Many of us have been in a situation where we’re actively waiting for a money transfer to arrive.

SpotMe is available to Chime members with total monthly qualifying direct deposits of $500 or more. That’s why Chime’s SpotMe feature offers Fee-free Overdraft up to $200* on debit card purchases with zero fees. But the big banks love overdraft because it’s a massive moneymaker for them: in 2019 alone, traditional banks charged customers $11 billion in overdraft fees. There’s nothing worse than getting dinged by your bank for dipping into overdraft. #3 Fee-free Overdraft up to $200* With SpotMe When you look at your Savings Account, though, there will be a lot more in there than you expected. The best part about automatic saving like this is that you never even notice the money leaving of your Spending Account. Round-ups tend to average out to about 50 cents apiece, so if you make 100 purchases over the course of a month, you can expect to have about $50 moved into your Savings Account automatically. Every time you buy something with your debit card, Chime will automatically round up to the nearest dollar and transfer the round-up from your Spending Account to your Savings Account. #2 Automatically Grow Your SavingsĪnother one of our favorite features of Chime is how easy it makes saving money. We’ll talk more about these and other fees later when we break down Chime’s three account types. If this doesn’t sound like a big deal, just look at how Chime stacks up against Chase and Bank of America:Ĭlearly, these are some big differences, and when you account for them month after month, you can save a lot of money by switching to Chime.

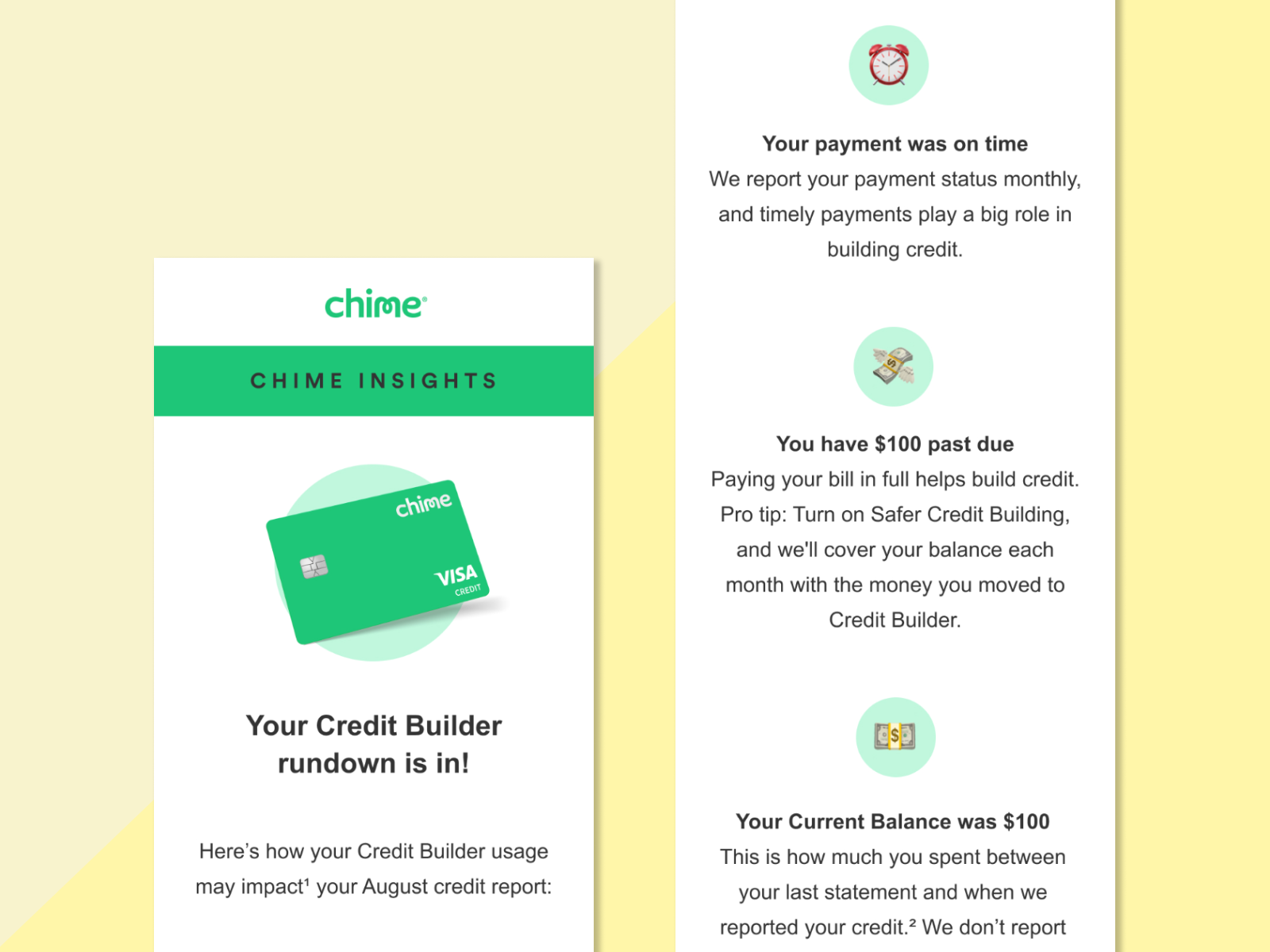

#HOW DOES CHIME CREDIT BUILDER WORK PLUS#

No ATM withdrawal fees at 38,000+ MoneyPass® and Visa Plus Alliance ATMs.Banking should earn you money, not cost you money, so in line with that, Chime has eliminated these fees:

Here are just four of the major benefits of banking with Chime: #1 Zero Hidden Fees˜Ĭhime’s core philosophy is that everyone deserves financial peace of mind. In this review, we’ll break down many of the features and benefits of Chime, its three different account types, its mobile app, who Chime is best suited for, and more. This is important, since about 6% of Americans are still “unbanked” due to structural barriers like a low credit score, according to recent numbers from the Federal Reserve. It doesn’t perform credit checks when customers open a new account, making it a great option if you have a poor credit score or are trying to restart your financial life. It eliminates the fees that many of the big banks charge, and has developed a reputation as an account that’s generous with interest rates and attentive toward its users.Ĭhime also calls itself a “second chance banking option,” and for good reason.

Chime is a financial technology company that prides itself on its transparent fee structure.

0 kommentar(er)

0 kommentar(er)